german tax calculator in english

Simply enter your annual salary to see a detailed tax calculation or select the advanced options to edit payroll information select different tax states etc. The German income tax is a progressive tax which means that the average tax rate ie the ratio of tax and taxable income increases monotonically with increasing taxable income.

The tax class combination IV IV statutory rule assumes that the Spouses life partners earn approximately the same amount.

. Overall tax for the couple when paying tax separately. You will most likely get a very high tax refund. Zasta is a different kind of tax software as it serves as a platform to connect you to a professional tax advisor.

Owes annual German income tax of 2701. You can do your tax return in Germany in English. The rate of income tax in Germany ranges from 0 to 45.

Best tax return software in Germany in English. They offer the following. German income tax rate in 2010 as a function of taxable income.

To get an idea of how much income tax you will have to pay you can use this income tax calculator in German. Just do your tax return with SteuerGo. High nominal tax rates dont hurt as much if the amount of taxable income is low.

German Tax categories and german tax law in english. Register and discover how easy it is to get an average tax refund of more than 1000 Euro online. You are required to file a tax return.

To improve the economic situation and infrastructure for certain regions in need the German government has been levying a 55 solidarity surcharge tax. All those who are self-employed in Germany are expected to file an annual tax declarationThe tax year in Germany runs parallel with the calendar year which means you should ideally be submitting your tax return in January each year although the deadline is the 31st May. Youll then get a breakdown of your total tax liability and take-home pay.

EUR 12409437 total tax charge income tax SoliZ 4137. This Income Tax Calculator is best suited if you only have income as self employed from a trade or from a rental property. Register free of charge.

The German Annual Income Tax Calculator is updated to reflect the latest personal Tax Tables and German Social Insurance Contributions. Form AUS - Foreign income and taxes Ausländische Einkünfte und Steuern deductions of foreign taxes on German income are caculated by entering the foreign income on the. Try before registering.

18014 a savings of 1715 per year. The Tax Class Lohnsteuerklasse or Steuerklassen in German is important in determining the amount of withholding income tax deducted from a salary as well as in determining the value of a number of social benefits for. The new procedure for calculating vehicle tax.

You can enter the gross wage as an annual or monthly figure. German Income Tax Calculator Expat Tax. The surcharge is imposed as a percentage on all individual income taxes.

You can find a FREE online tax calculator in English language the most frequently asked tax questions by expats living and working in Germany here expattaxde. German Grossnet Calculator Wage Calculator for Germany. All five software providers calculate an average tax return of more than 1000 euros.

A Tax class combinations. Surcharges on income tax. You are a resident of Germany since 2020 irrespective of you citizenship.

To calculate the German income tax you owe on your wages you can use the SteuerGo tax calculator. In addition to calculating what the net amount resulting from a gross amount is our grossnet calculator can also calculate the gross wage that would yield a. Tax return 2021.

Hundreds of thousands of satisfied customers. New platforms have appeared the past few years to help expats do their taxes 100 in English. Salary Before Tax your total earnings before any taxes have been deducted.

Joint couples tax using Steuerklasse 3 and 5. Germany is certainly not a low-tax jurisdiction. Check in real time how high your return will be.

Since September 2018 in Germany and 2019 in Europe the calculation of motor vehicle tax is based on data obtained by a globally harmonized test procedure for determining the values of pollutant and CO2 emissions known as WLTP Worldwide harmonized Light Duty Test Procedure. How much money will be left after paying taxes and social contributions which are obligatory for an employee working in Germany. Annual tax return Steuererklärung.

Also known as Gross Income. The calculator covers the new tax rates 2022. Our gross net wage calculator helps to calculate the net wage based on the Wage Tax System of Germany.

The German Annual Income Tax Calculator for the 2022. But it is also not as bad as a lot of people think. German Income Tax Calculator.

If you work in Germany full-time or during your studies its good to know the basics about German income tax. They also offer to enter your data first so they function as a German tax refund calculator. If you wish to calculate your salary Social Insurance payments and income tax for a differant period please choose an alternate payment period or use the Advanced German Tax Calculator.

The SteuerGo Gross Net Calculator lets you determine your net income. The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year. You can enter your details on Zasta for free and you will get a pre-calculated tax return offer from a.

Tax Calculation Example using an income tax calculator provided by the German Federal Ministry of Finance BMF. This program is a German Income Tax Calculator for singles as well as married couples for the years 1999 until 2019. Your hand is really guided step-by-step with the tool in a clean interface.

If you receive a salary only as an employee on a German payroll you get. Filing your tax return is worth it. A large proportion of taxpayers in Germany both expats and German citizens choose to submit an annual income tax return Einkommensteuererklärung to the Federal Central Tax OfficeBy submitting a tax declaration you check that you have paid the correct amount of tax for the previous financial year.

Personal tax allowance and deductions in Germany. You can expect a high tax refund. Zasta translated by Google.

Employees of German companies are normally assigned a tax class by the tax authorities according to various categories. Try it for free. Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Germany affect your income.

Our grossnet calculator enables you to easily calculate your net wage which remains after deducting all taxes and contributions free of charge. If youre struggling to visualise how all of this affects your income a German tax calculator can give you a good idea of how much money youll actually take home each month. Here are our top picks for the best tax return software in Germany in English.

This more accurate calculation leads to an. Your taxable worldwide income in FY 2021 is EUR 300000. The tax class combination III V is designed so that the sum of the.

German tax burden for FY 2021. In the results table the calculator displays all tax deductions and contributions to mandatory social insurance on an annual and monthly basis. ESt 1 V - Simplified income tax return Vereinfachte Einkommensteuererklärung double-sided tax form that significantly reduces the time required and focuses on essentials.

Calculate your Gross Net Wage - German Wage Tax Calculator. As of 1 January 2021 the application of the solidarity surcharge tax has been substantially. The first German tax return in English for all expats.

Millions of euros in tax refunds for.

Cofinimmo Vs Aedifica Which Healthcare Reits Is Better Elderly Care Center Health Care Finance Blog

Vat Calculator 2022 Add Or Remove Value Added Tax Online

5 Best Crypto Tax Software Accounting Calculators 2022

Tax Rates Mpac Assessments North Dundas

France Salary Calculator 2022 23

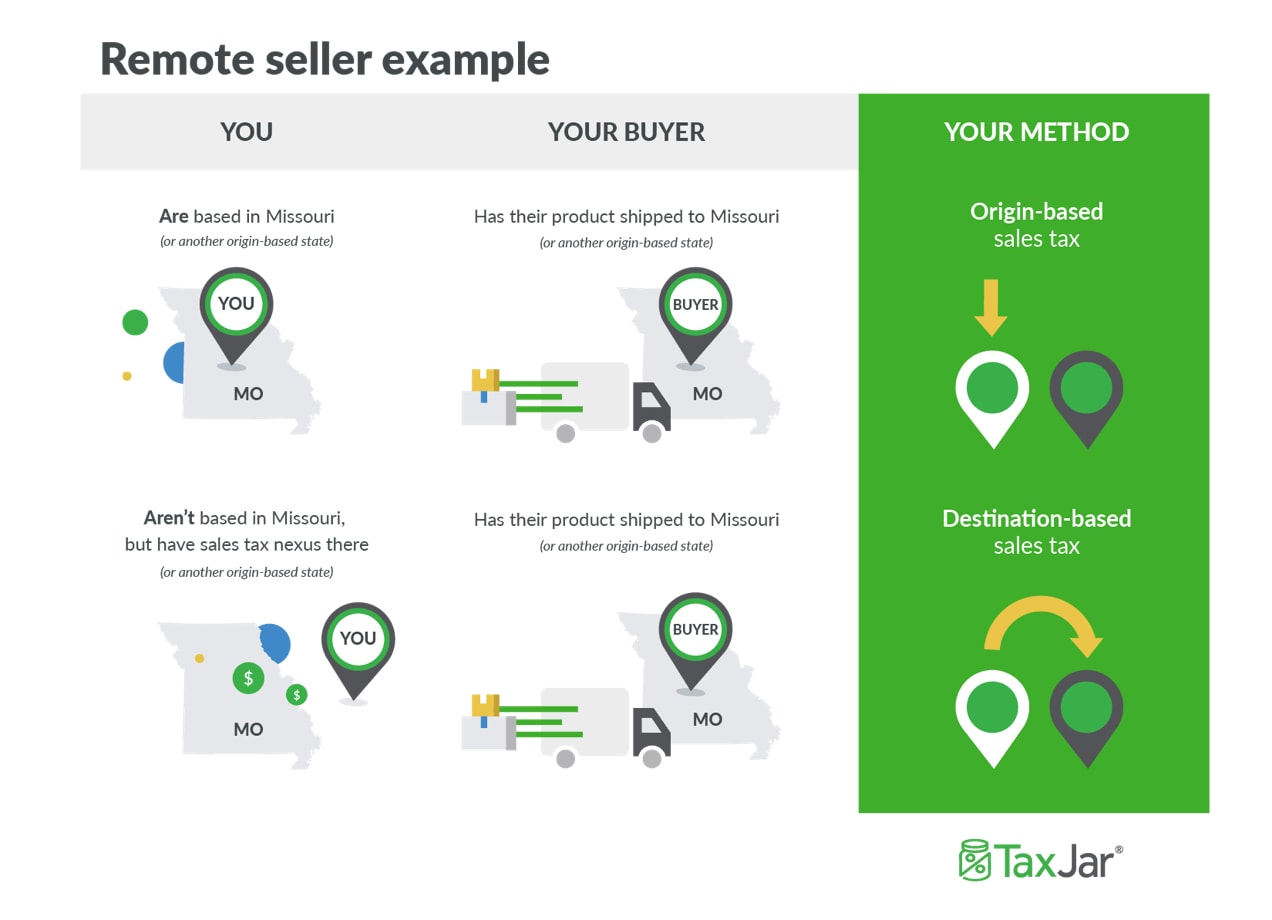

How To Charge Your Customers The Correct Sales Tax Rates

Canon Dk 1000i Ii Usb Portable Numeric Keypad Calculator W Trackball By Canon 19 99 Canon Dk 1000i Ii Usb 12 Numeric Keypad Desktop Calculator Calculator

Pin On Wallpapers And Backgronds

5 Tax Apis Free Alternatives List March 2022 Rapidapi

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Foreign Earned Income Exclusion And Us Or Irs Tax Returns

Calculez Votre Devis Banderole Actualites Du Net Referencement Efficace Sur La Longue Traine Lawyer Logo Business Cards Business Man Calculator

How To Charge Your Customers The Correct Sales Tax Rates

Best English Accounting Software In Germany 2021 Update Accounting Software Invoicing Software Bookkeeping Software

Crypto Tax 101 Is Crypto Taxed Koinly

Download Income Tax Calculator Fy 2021 22 Ay 2022 23 Income Tax Income File Income Tax

Tax Invoice Template Invoice Format Invoice Template Invoice Template Word